- Job Title: eTrading KDB Developer

- Salary: $163,500 – $245,300 a year

- Location: New York, NY

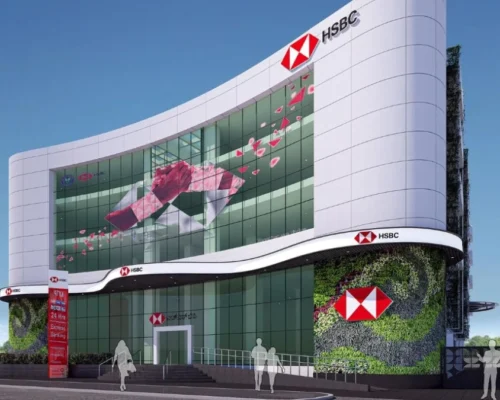

- Company: HSBC

- Qualifications: Bachelor’s degree

- Experience: 3-5 years

- Job Type: Full-time

ABOUT HSBC

HSBC US is a key division of HSBC Holdings, one of the world’s largest banking and economic offerings corporations. Operating across America, HSBC US provides a vast variety of financial services, consisting of personal banking, wealth control, industrial banking, and international banking and markets. Headquartered in New York, HSBC US serves each home and international clients, leveraging its global network to assist go-border exchange and investment.

Committed to innovation, HSBC US gives modern virtual banking answers at the same time as retaining a focal point on sustainability and network development. The business enterprise actively promotes range, fairness, and inclusion inside its staff and targets to contribute definitely to the American financial system. With a legacy of over 150 years, HSBC US maintains to build strong customer relationships, ensuring security and success in an ever-evolving financial panorama.

Job Description:

Seeking a professional eTrading KDB Developer to design, develop, and hold high-overall performance KDB+/q-based total applications for actual-time buying and selling structures. Responsibilities encompass building analytics tools, optimizing facts garage, and ensuring low-latency records processing. Collaborate with trading, operations, and IT groups to accumulate necessities and enhance system performance. Strong knowledge of KDB+/q, time-collection facts, and database optimization is vital. Experience in digital trading platforms, scripting, and troubleshooting is desired. Excellent hassle-fixing abilities and a proactive attitude are key to achievement in this dynamic role.

Qualifications and Skills for eTrading KDB Developer

Qualifications:

Educational Background:

- Bachelor’s or Master’s diploma in Computer Science, Engineering, Mathematics, or ann associated discipline.

- Advanced certifications in information technological know-how, financial structures, or programming languages are a plus.

Technical Expertise:

- Proficient in KDB+/q programming, along with schema layout, question optimization, and overall performance tuning.

- Strong information on time-collection databases and actual-time statistics processing.

- Familiarity with digital trading systems, market information feeds, and financial contraptions (e.g., equities, FX, or fixed earnings).

- Hands-on enjoy with Linux/Unix environments for deployment and debugging.

Experience:

- 3-5 years of experience in developing and managing KDB+/q structures in a trading surroundings.

- Experience with messaging protocols including FIX or marketplace records APIs is pretty proper.

- Background in high-frequency or algorithmic trading structures is effective.

Skills:

Programming and Development Skills:

- Strong programming capabilities in KDB+/q and other languages like Python, Java, or C++ for integrations.

- Familiarity with scripting languages (e.g., Bash, Perl) to automate operational obligations.

- Knowledge of model control structures such as Git.

Analytical and Problem-Solving Skills:

- Exceptional capacity to analyze, debug, and resolve low-latency overall performance troubles.

- Aptitude for running with massive, complex datasets and turning in optimized solutions.

Domain Knowledge:

- Comprehensive knowledge of buying and selling workflows, order e-book control, and marketplace microstructure.

- Knowledge of change control and compliance systems in electronic trading.

Interpersonal and Communication Skills:

- Effective in communicating technical concepts to non-technical stakeholders.

- Strong teamwork and collaboration abilties to work with investors, quants, and IT teams.

Adaptability and Innovation:

- Ability to analyze new technologies and adapt quickly in a quick-paced trading environment.

- A proactive approach to staying updated on enterprise developments and rising technology.

This position needs a mixture of technical skillability, financial area knowledge, and a collaborative attitude to excel in high-performance trading environments.

Click Here to Apply Now

More Other Job’s

Senior Product Operations Manager job

Infrastructure DevOps Platform Engineer job

Note: We are also on WhatsApp, LinkedIn, Google News, and YouTube. To get the latest news updates, Subscribe to our Channels: WhatsApp—Click Here, Google News—Click Here, YouTube—ClickHere, and LinkedIn—Click Here.